E-health insurance is defined as electronic health insurance or otherwise called online health insurance. It can be claimed online by uploading the proper documents and the medical prescription with reports of a patient. During the period of covid’19, many people get benefitted from this method. In the olden days, these facilities are not available but the present scenario helps people to claim all kinds of insurance through this online mode of payment. Dr. Emad Zaki M.D. also suggested many people claim through these policies.

Mode of Application

The first step is that choose the right company for claiming medical insurance for the disabled. There is an application to fill in your details. After furnishing all the details, people will receive a quote of different policies and people can choose their policy on their choice and requirements. After selecting the insurance plan and add some additional information and proceed for payment. A monthly premium can be paid and claim of bills and other medical expenses are done quickly and it benefits the people in a place where they are.

Services

Financial Stability

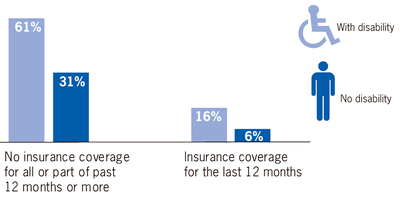

These services help the people to suffer from a financial crisis during the medical emergency of the disabled to involve a vast amount in treating them to bring back to the normal position of disability. If it became serious it would become a dangerous thing for disabled persons. It covers the in-patient hospitalization of pre and post-hospitalization to the sum insured.

Peace of mind

It means it helps the family members of the disabled to concentrate more on the disabled person peacefully by relaxing them from the stress and burden of money. In the present day, money plays a vital role, so these online insurance are helping the people as a motivator and gives them peace of mind and hope to recover from that crucial position.

Quality medical treatment

These insurance policies offer people timely help and also quality medical treatment in hospitals. Only the high quality of hospitals are covered under medical treatment. It satisfies the people more to put many policies and to link as many as possible to draw a link of chain.

Family floater

The family floater is a policy that covers the whole family in a premium policy of the individual. It carries 5 members and children also included. It is the most beneficiary policy for the family.

Co-Payment

It is a share that can be claimed at the time of settlement once the policy is over, for that there is no reduction in the insured amount.

Tax benefits

Tax benefits are also available in the online insurance policy.

Daycare treatment

It is the initial step in the treatment of a patient in daycare under anaesthesia for a certain time for observation. It can also be claimed under the insurance policy.

Freelook Period

It is a period which is given to the new policyholder for the first time, in that particular period, the policyholder can review the policy and if they found it beneficial then they can continue it or if they are not satisfied they can return the policy and move on to the next policy which suits them well and good.

Thus online health insurance is providing its services in its best to meet the needs of the people even on pandemic days.